Investing for high profits depends on a number of factors such as the ability to choose the right investment tools and a rewarding investment company. Since your growth depends on the growth of the investment company you choose, you should make thorough research to know if the company you are about subscribing to is worthwhile. This is especially important if you are saving for the future. Some companies perform much better than the others and a good example of such companies is Fidelity. Fidelity review shows the company has a good background that makes it a safe place to make plans for your retirement.

Who Is Fidelity?

Fidelity is an investment company that has been in operation for over 60 years. The company was established in 1946 to offer a range of financial services and investment opportunities. Fidelity is the place to go if you want mutual funds, trading services and financial products such as 401(k). Fidelity's headquarter is in Boston but you can also enquire about its services by walking into any of its numerous branches or by calling their hot lines.

Fidelity is an investment company that has been in operation for over 60 years. The company was established in 1946 to offer a range of financial services and investment opportunities. Fidelity is the place to go if you want mutual funds, trading services and financial products such as 401(k). Fidelity's headquarter is in Boston but you can also enquire about its services by walking into any of its numerous branches or by calling their hot lines.

The company's staff number over 42000 and they are spread across the US and Canada. There's hardly any other company in the industry with the same staff strength. You can rely on Fidelity for retirement planning and brokerage service. The company has up to 11.9% market share for assets.

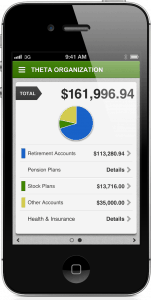

Another benefit of the company is the plethora of knowledge it provides its customers through its Fidelity Learning Center. The Learning Center can be assessed on your smart phone after installing the mobile application. The learning center is a place to learn about other investment products.

How Much Does It Cost?

The cost depends on the service you want. The kind of account you open determines how much you will pay. Some of the different accounts include individual retirement account, cash management and brokerage. They also cater for people who want to save for their children's education. If your Roth IRA or traditional IRA account still exists, you will need at least $2500 or $200 per month to open an account. While you may pay as much as $2500 for the brokerage account, your 529 accounts can remain active with just $50 or $15 per month.

The cost depends on the service you want. The kind of account you open determines how much you will pay. Some of the different accounts include individual retirement account, cash management and brokerage. They also cater for people who want to save for their children's education. If your Roth IRA or traditional IRA account still exists, you will need at least $2500 or $200 per month to open an account. While you may pay as much as $2500 for the brokerage account, your 529 accounts can remain active with just $50 or $15 per month.

Advantages

Apart from the online Research Learning Center, you will also enjoy the customer support center, which can be accessed anytime of the day. Their mutual funds are cheaper than any other in the industry. Their major customers always get updates on the next profitable place to invest. The company has gained several commendations from international organizations such as Barron and Smart Money.

Important Points to Consider

Fidelity is a place for those who are thinking about long term benefits. Don't invest in Fidelity if you want your profits within a short period. Finally, Fidelity is a place for new investors so if you are already an expert, you may not like their features.

In Conclusion

This Fidelity review suggests that the company is one of the most experienced in the field. New investors feel safe by diversifying their funds in the different investment options. Since the company's aim is to serve you on a long term plan, it may not be the right place to trade precious metals.